Compare the best loans Quickly and Easily

Are you looking for a loan but don’t know how much it will really cost? With our online loan comparator, you can quickly compare the different options available.

Find out what the interest rate is, the value of the payments and choose the option that best suits your needs. Start planning your finances smarter today and secure the best deal with just a few clicks!

Benefits of a Loan Comparator

Our online personal loan comparator is designed to make your financial experience easier and ensure you find the best option available in South Africa:

- Ease of Use: Our platform is intuitive and easy to use. Enter the amount you wish to borrow and the term you would like to repay it, and our simulator will do the rest.

- Quick Comparison: With just one click, you can compare different personal loan options available on the market.

- Immediate and Free Access: Access our simulator free of charge and without the need for prior registration.

- Total Transparency: We offer you detailed and up-to-date information on each loan option. There are no hidden costs or small print; everything is clear from the start.

- Informed Decision: With all the information at your fingertips, you can make an informed decision about which personal loan best suits your needs and repayment capacity.

- Security and Trust: We operate with the highest online security standards to protect your personal and financial data. Trust our simulator to find the best options safely and securely.

How does the Loan Simulator work?

To use the Quotes Advisor online loan comparator, please follow the steps below:

- Select the amount of credit you want to obtain.

- Indicate the term over which you want to repay the money.

- Click on ‘Compare Loans’.

- Choose the most convenient option.

- Apply your personal loan with the selected entity.

Once you have done the simulation, compared and selected the best option, we will connect you directly with the selected entity to conclude with them your application process and subsequent disbursement of the money.

Best Options for Applying for Personal Loan Online

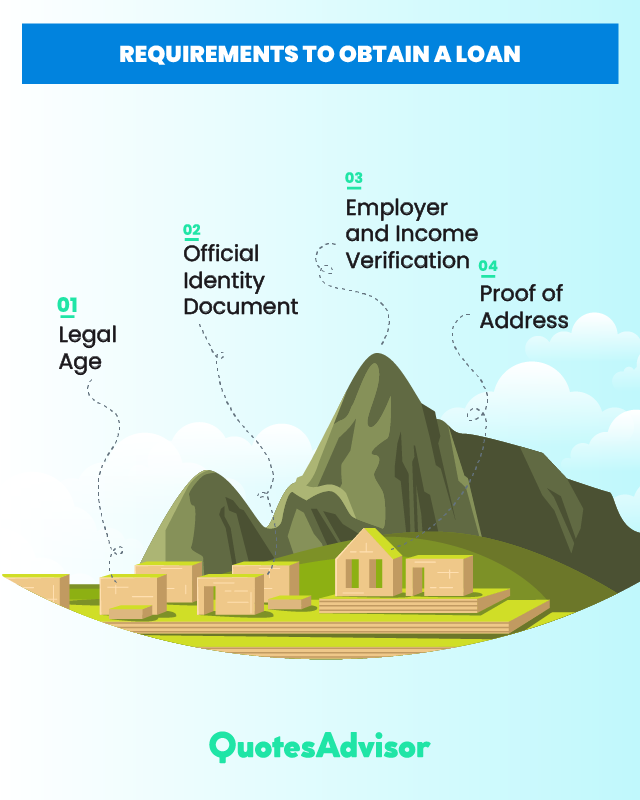

Requisitos para obtener un préstamo personal

There are four general conditions or requirements that are repeated in almost all financial institutions when you want to apply for a personal loan.

If you meet these, we recommend that you use our loan simulator so that you can compare the different companies and options offered by the South African market.

Official ID

Legal Age

Proof of Income

Proof of address

Are Online Loans Secure?

Yes, online personal loans are reliable, but we must always take into account the entity where you are going to apply for it. Through Quotes Advisor Personal Loan Comparator we look for the safest options in the South African market so that when you compare you get reliable and secure options.

We recommend that you always make your own enquiries about the company or companies with which you want to apply for credit so that you can feel confident in your decision and contract.

Is it important to use a Personal Loan Comparator?

Comparing loans through a tool such as ours is the best way to find the most suitable option, with an appropriate rate and that really meets the need you have at that moment. Nowadays, through these tools, you can get almost 100% access to clear information about the different financial companies without intermediaries.

Learn about Loans

If you need more financial information or information about the online loan comparator we invite you to visit our blog and learn more about this type of loans so you can make an informed decision.

Where to get a personal loan in South Africa?

In South Africa there are many financial institutions offering different types of loans. For this reason, we always recommend you to use the loan simulator and compare each of the options before contracting.

- Gauteng

- Johannesburgo

- Pretoria

- Soweto

- Western Cape

- Ciudad del Cabo (Cape Town)

- Stellenbosch

- Paarl

- KwaZulu-Natal

- Durban

- Pietermaritzburg

- Richards Bay

- Eastern Cape

- Port Elizabeth

- East London

- Bhisho

- Northern Cape (Cabo Septentrional)

- Kimberley

- Upington

- Free State

- Bloemfontein

- Welkom

- Limpopo

- Polokwane

- Thohoyandou

- Mpumalanga

- Nelspruit (Mbombela)

- Witbank (eMalahleni)

- North West (Noroeste)

- Mahikeng

- Rustenburg

- Potchefstroom

Frequently Asked Questions (FAQs)

What is a personal loan?

A personal loan is a contract between a financial institution and a natural person, in which the former lends the latter a certain amount of money. The person acquires the obligation to return the amount, with the interest set and agreed by both, including expenses incurred to carry out the operation.

What are the Characteristics of personal loans?

Personal loans present a series of their own characteristics that you should know.

They are normally used to acquire a consumer good or service.

They can be useful to cover an emergency (eg a debt or medical expense)

They do not require a guarantee. It is answered with its own assets.

They generally do not require a guarantee.

Depending on where it is requested, it may or may not require having a bank account.

Normally they are low amounts of money due to their high payment risk.

In general, they do not have a cost of granting.

The procedures are usually simpler compared to other types of loans.

They can be requested online.

How to apply for personal loans?

Applying for a personal loan at Quotes Advisor is easy, fast and you can do it online. What you must do is indicate the amount of money you need and the payment period in which you want to return it in our quote. Once this is done, we will provide you with a complete list with the best options at the moment and we will indicate the approximate amount of fee that you must pay.

How to get a personal loan with a good interest rate?

As you may be well aware, personal loans interest rates are set on the basis of different factors. Your salary and your credit history will play a great part in how low or high is the interest rate a lender can offer you. If, after evaluating your information, the credit lending provider concludes that you represent a low risk, then you will get a better rate. However, there is one thing you should consider to get the lowest interest rest possible: more months you take to pay back your loan the higher the interest rate.

How do I know if I qualify for a specific loan amount in South Africa?

Usually, to be eligible to request for personal loans, you need to be under permanent employment and many banks even ask you to earn a minimum amount each month to ask for their loans. This factors will mainly affect the amount you qualify for to borrow.

What are personal loans for?

A personal loan is a way of acquiring money that will allow you to cover an economic need, for example, to acquire a good or service. Normally they are used to buy a vehicle/house, pay for studies, vacations or services. Given the case, they are also a good option if you need to pay a debt urgently or when you have a medical need but do not have the necessary money to cover it.

¿Existe la posibilidad de obtener préstamos por 15000 Soles?

Es posible sin lugar a dudas tener esa cantidad de dinero sólo presentando su DNI, pero otra cosa que se le va a pedir, que no es documentación, que tenga previamente calificaciones de crédito positivas. Los montos que van a tener en dicho crédito son desde S/. 2,000 hasta S/. 50,000. Tiene ventajas este crédito como poder darle cuotas fijas, pagos mensuales, cancelaciones anticipadas sin costos, cuenta en todo momento con seguro de desgravamen, entre muchas otras.

What should you know before applying for a personal loan?

There are some important terms that you should know before requesting or applying for a personal loan, these are:

Principal: It is the amount of money that you borrow from the entity. For example. If you request a personal loan of $2.000, the principal is that value.

Interest: It is the charge that the entity that acts as a lender will include for granting you the money and returning it after a certain time.

Annual Percentage Rate (APR): Fee charged by the entity when making the loan, apart from the interest rate.

Term: The number of months in which you will return the money.

What Type of loans are in South Africa?

There are different types of loans: Personal loans, Fixed rate loans, Payday loans, Commercial loans, Vehicle loans, Mortgage loans, Pensioners loans.

How should I compare personal loan quotes?

There are three main aspects that you should have in mind to compare the personal loan quotes you got and choose the cheapest and safest one:

Is the loan secured or unsecured? Secured loans are the ones that require you to provide an asset as guarantee, for example, a car or a piece of jewelry. Conversely, unsecured loans are not protected by any item. Thus, if you take out a secured loan and fail to repay the loan, whatever asset you provided as guarantee will be used to procure payment.

How much can I borrow? Before you start your loan search, think about the amount of money you will need to borrow. This will help you narrow down your search, since not all providers offer the same maximums.

How quickly is the loan approved? Another factor which might determine the decision is how fast you need the loan. Traditional banking institutions tend to ask for stricter requirements, and, thus, they might take a little longer to approve your loan. If you want the money now, you can consider online lending companies that usually process the information much faster.

What is a personal loan calculator?

A loan repayment calculator is a tool that lets you estimate the amount of money you will have to pay each month to repay your loan.